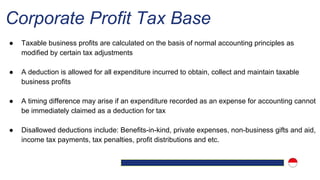

are funeral expenses tax deductible uk

Any travel expenses incurred by family members of the deceased are not deductible. An executor or administrator is under a duty to have the deceaseds body buried or to arrange cremation and their reasonable expenses for doing this are allowed.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172.

. Funeral costs arent tax-deductible for individuals. If any funeral cost is relevant to the ceremony or. You will need to consider what is reasonable on a case by case basis.

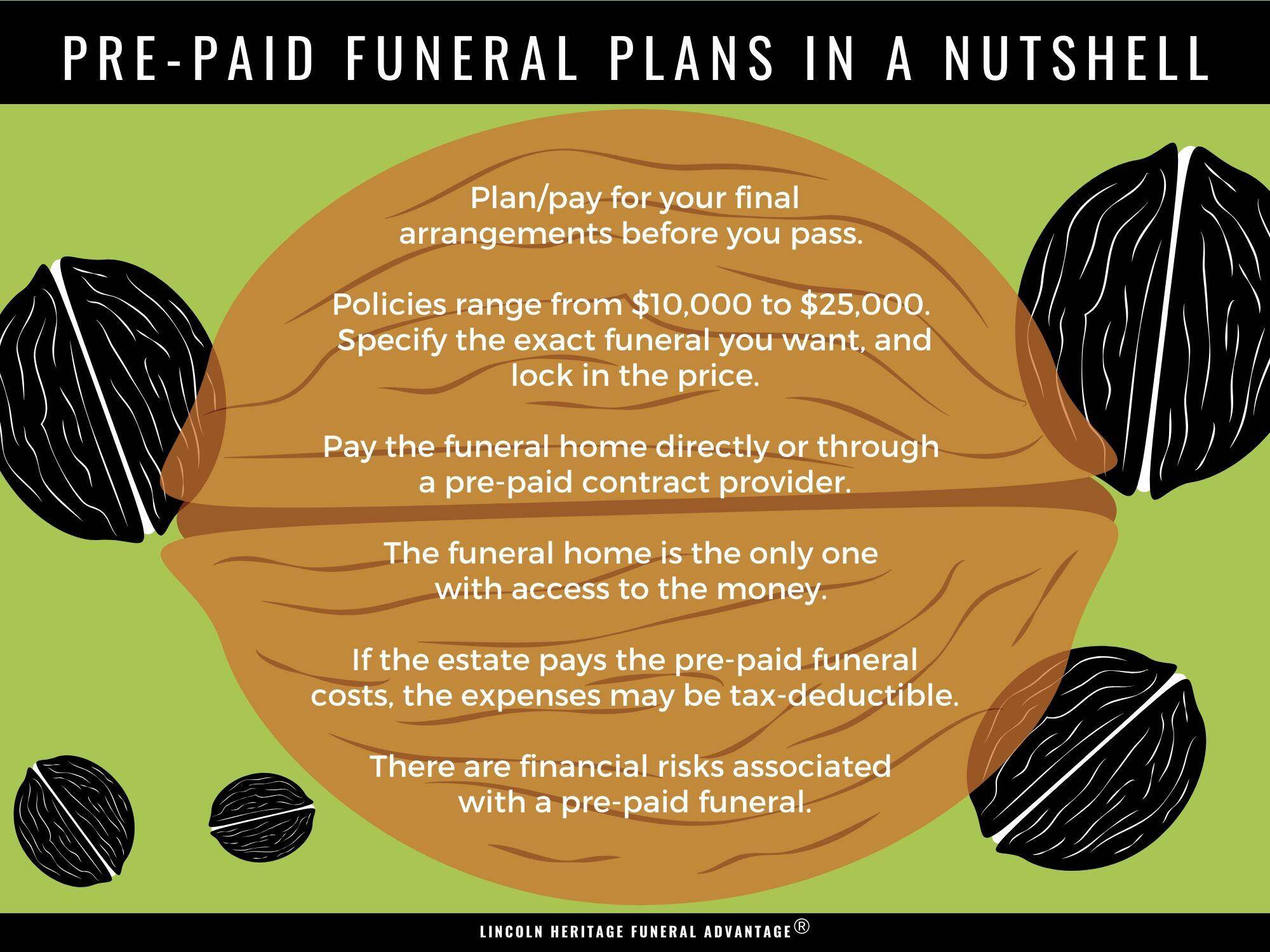

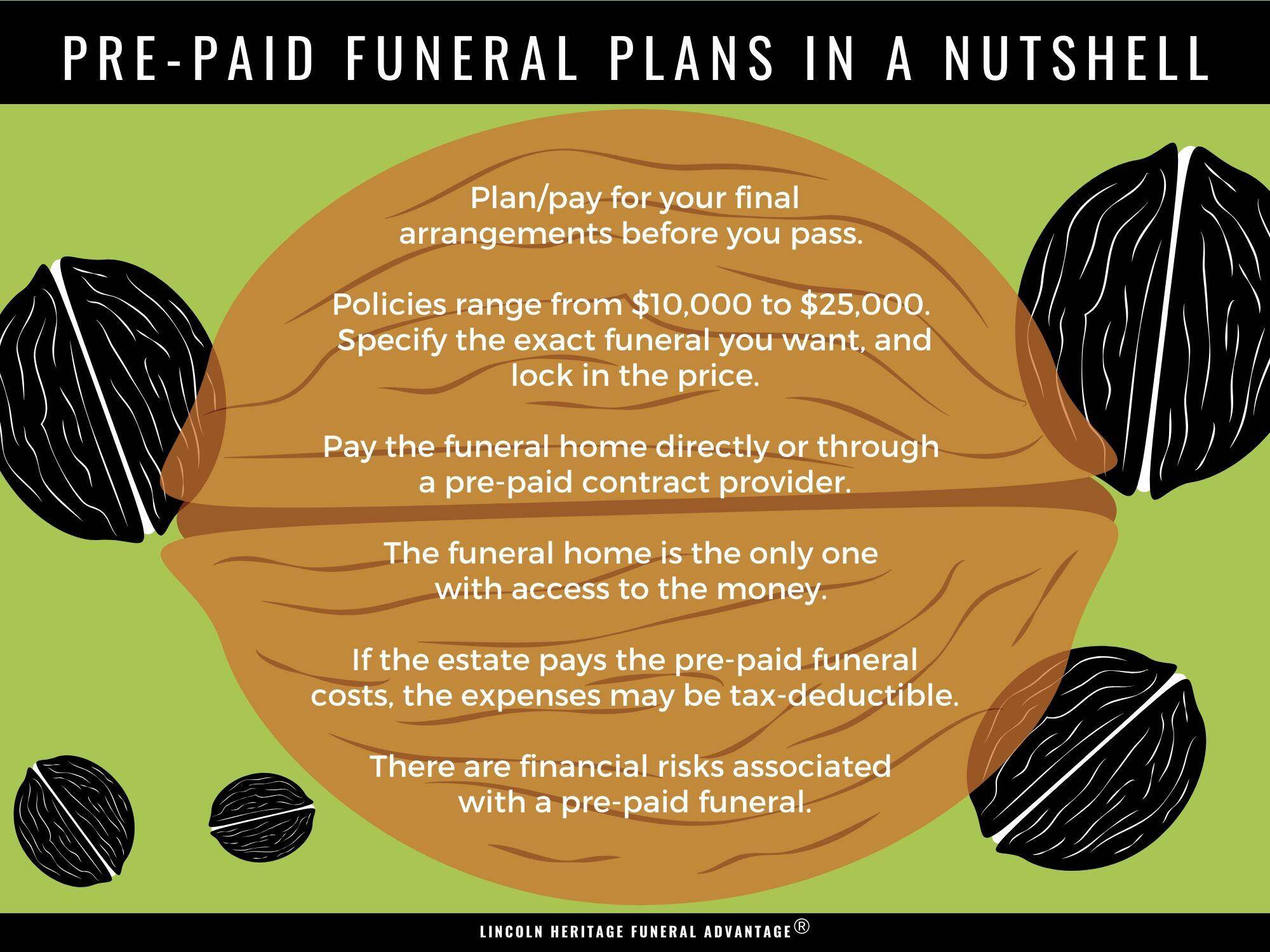

Although IHTA84S162 5 might seem to justify the deduction of such expenses from the non-UK estate that sub-section cannot apply as funeral expenses are not a liability for the purposes of. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning expenses. Unfortunately funeral expenses are not tax-deductible for individual taxpayersThis means that you cannot deduct the cost of a funeral from your.

The estate includes any money or property they had but not a house or personal things. Your Funeral Expenses Payment will be deducted from any money you get from the deceaseds estate. What funeral expenses are deductible.

Funeral Expenses Tax Deductible Uk The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Gravestones and memorials You should allow as a reasonable funeral expense the cost of a headstone that finishes off describes and marks the. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

My understanding is that the reasonable funeral costs could be deducted for IHT if they are paid or to be paid by the estate but if in fact they are not paid by the estate that is. Funeral expenses are included in box 81 of the IHT400. Are Funeral Expenses Tax Deductible.

- SmartAsset The IRS does not allow funeral expenses to get deducted. However you may be able to deduct funeral expenses as. Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions.

Expenses can include a reasonable amount to cover the cost. However only estates worth over 1206 million are eligible for these tax. With burial costs being a significant expense its common to wonder if funeral expenses are tax.

Funeral expenses are never deductible for income tax purposes. A couple of funeral expenses are not eligible for tax deductions. IHTM10373 - Funeral expenses box 81.

Any individual even the ones who personally paid out-of-pocket will not be able to claim funeral expenses on his or her. I would say deductible and the benefit is taxable on the deceaseds personal representatives under ITEPA 2003 section 394 by virtue of section 393B1c but what do I. However qualified medical expenses incurred prior to the death in an attempt to treat an.

Cremation costs were slightly lower at an average of nearly 7000. People who are paying taxes on individual income cant deduct funeral expenses. If the estates funds are used to pay the costs of the funeral those costs can be deducted on the estates estate tax return.

Although in law mourning expenses are not strictly funeral expenses where appropriate the deduction of reasonable. The IRS views these. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

Taxpayers are asked to provide a.

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

5 Tax Deductible Expenses For Executors Fifth Third Bank

Doc Tax Handout Denmak Nyasha Admire Chemhere Academia Edu

Plan F Infographic Medicare Supplement Medicare Supplement Plans Medicare

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Are Funeral Expenses Tax Deductible

Are Funeral Expenses Tax Deductible

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Small Business Tax Deductions Tax Deductions

Editable Browse Our Image Of Charitable Donation Letter Template Corporate Fundraising Letter Donation Letter Template Donation Letter Fundraising Letter

Are Funeral Expenses Tax Deductible

If My Employer Is Not Providing Me A Computer To Work With And I Have To Buy One Can I Deduct It As A Business Expense If I Don T Own A Business

Why Tax Deductions Are So Important For Your Business Tax Write Offs Business Tax Business Finance